Ultimate 2025 guide to Australia’s best VA services, highlighting savings, skills, and top firms for business growth.

- Home

- Blogs

- Payrolling Virtual Assistant Services in the USA: The Deep-Dive Guide for Business Owners (2025)

Payrolling Virtual Assistant Services in the USA: The Deep-Dive Guide for Business Owners (2025)

Discover Payrolling Virtual Assistant Services in USA for cost-effective, compliant payroll management boosting business agility in 2025.

Key Takeaways:

Introduction: What Is Payrolling Virtual Assistant Services?

How Virtual Assistant Payrolling Works in the USA

Cost Comparison Table: In-House vs. Virtual Assistant Payroll Services

Top Payroll Virtual Assistant Service Packages (with Rates)

Leading Payroll VA Companies: Features & User Ratings

Payroll Compliance: IRS, Contractor, and Employee Status Explained

The Onboarding Process: Best Practices for U.S. Businesses

Introduction: What Is Payrolling Virtual Assistant Services?

Payrolling virtual assistant services refers to hiring remote professionals who specialize in payroll processing and related administrative tasks, working for your business via digital means but not as traditional employees. U.S. businesses use these services to handle everything from wage calculations and compliance tracking to paperwork, onboarding, and even HR communication, all remotely.[1][2][3]

The main approaches include:

- Direct Contractor/Vendor Model: Pay a VA agency or freelancer directly for payroll work.

- Agency Payrolling: Use a managed service for payroll, compliance, and HR recordkeeping.

- Hybrid Models: Combine payroll VAs with in-house leads for maximum cost savings and strategic coverage.

How Virtual Assistant Payrolling Works in the USA

Core VA Payrolling Tasks

- Accurate wage calculation, payslip creation, and payment scheduling

- Tax deductions, benefits administration, and compliance checks

- Payroll reporting (monthly, quarterly, annual)

- Filing year-end statements (e.g., W-2, 1099 forms)

- Employee time and attendance tracking with HR software integration

Supporting HR/finance for audits, onboarding, and queries

Tech Integration

Modern payroll VAs leverage cloud-based solutions and tools such as QuickBooks, Gusto, ADP, Xero, Paychex, BambooHR, and customized portals for:

- Real-time time tracking

- Automated tax calculations

- Direct deposit & global payments

- Detailed, secure recordkeeping

Cost Comparison Table: In-House vs. Virtual Assistant Payroll Services

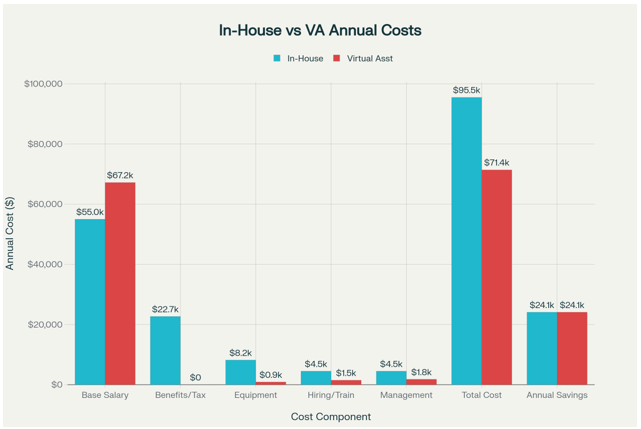

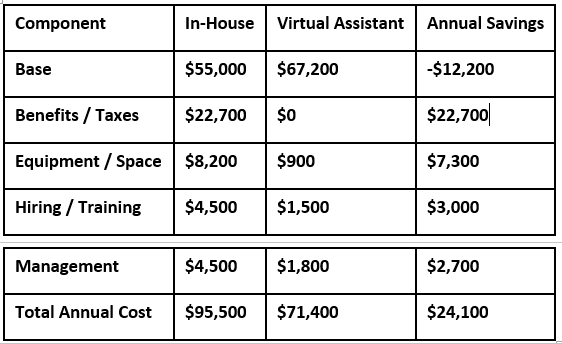

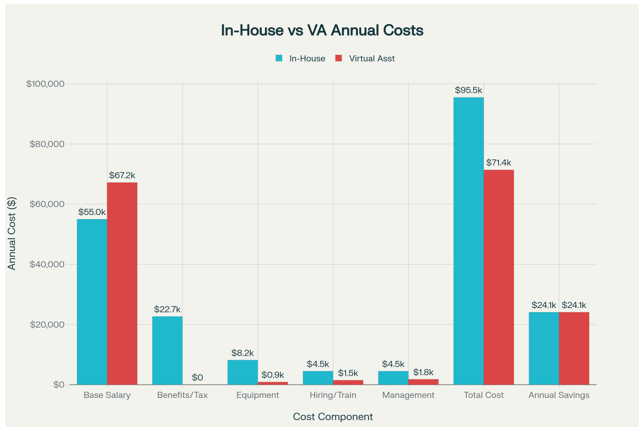

Payrolling through VAs commonly delivers 30–50% annual savings over in-house payroll processing (salary, taxes, benefits, and overhead included). Here’s a breakdown for a mid-level administrative payroll role in the U.S. market:

Cost comparison: In-house vs. Virtual Assistant payroll management (Mid-level, annual, USA)

Key Takeaway

Virtual assistant payroll services typically bring 25–60% cost savings with added scalability and flexibility for growth

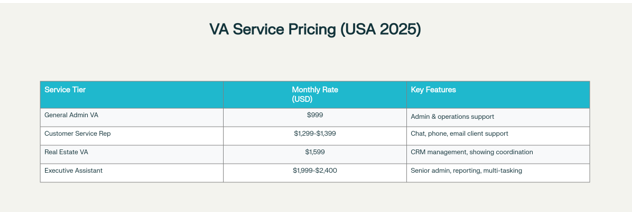

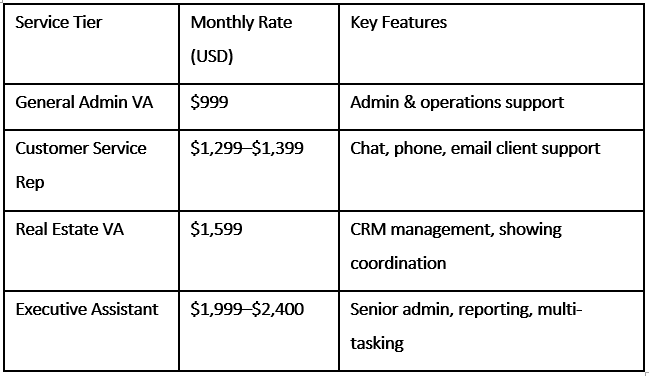

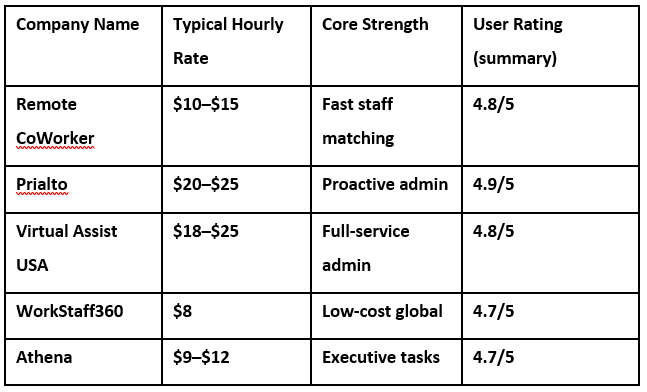

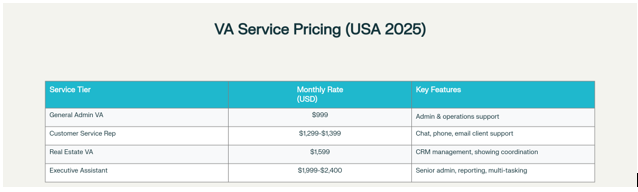

Top Payroll Virtual Assistant Service Packages (with Rates)

Payroll Virtual Assistant Service Packages & Rates (USA, Nov 2025)

Hourly rates for payroll VAs range from $8 to $25/hr depending on role and experience

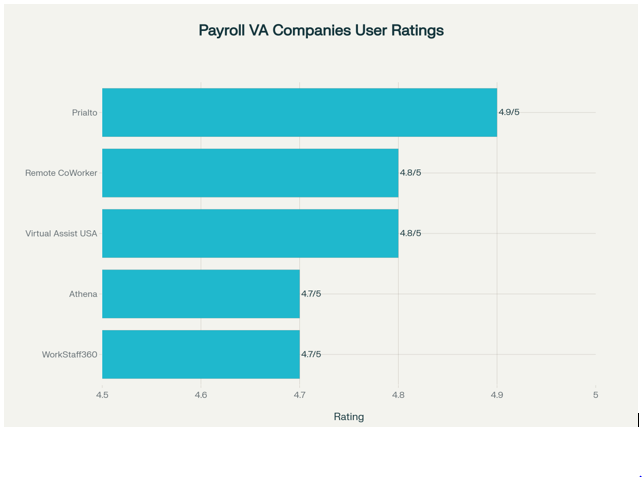

Leading Payroll VA Companies: Features & User Ratings

Top Payroll Virtual Assistant Companies in the USA (2025)

User feedback highlights time saved, improved payroll accuracy, fast onboarding, and scalable plans tailored to different industries and business needs.

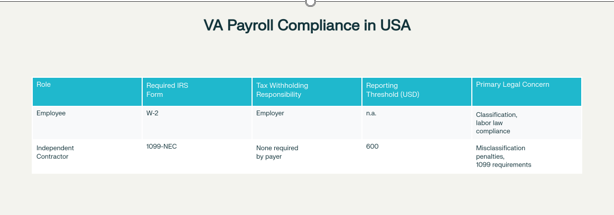

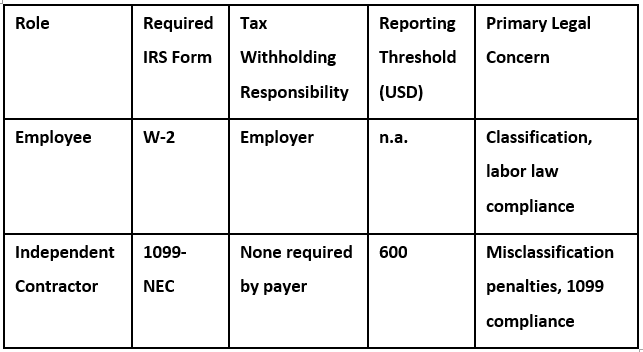

Payroll Compliance: IRS, Contractor, and Employee Status Explained

Payroll Compliance for Virtual Assistant Services in the USA: Key Legal & Reporting Differences

IRS Compliance

If your VA is an employee, file a W-2 and handle withholding taxes. Most U.S. VAs are classified as independent contractors, triggering a 1099-NEC filing for annual payments over $600

State-level Nuances

Some states have special tests for employment status—consult a tax or legal expert for details.

Software Integration

Payroll VAs can integrate seamlessly with HR and payroll software, and often assist with onboarding and compliance reporting

The Onboarding Process: Best Practices for U.S. Businesses

A well-structured onboarding process for a payroll VA boosts retention and accelerates productivity. Key steps include:

Define the VA’s Role & SOPs

Document all critical payroll and admin tasks; clarify frequency, tools, and KPIs

Set Up Communication Channels

Email, Slack, Zoom, or Teams for ongoing updates and approvals

System Access

Grant VA access to payroll and HRIS platforms, ensuring data security protocols

Company Orientation

Introduce the VA to company culture, mission, and direct team members

Training & Tools

Provide guides, video tutorials, and live walk-throughs of payroll systems/software

30-60-90 Day Plan

Set clear milestones with feedback and check-ins for skill development and alignment

Ongoing Support

Regularly update SOPs, offer a peer mentor or direct line for queries, and conduct periodic reviews

How Payrolling Virtual Assistant Services in the USA Are Benefitting Businesses

Key strategic and financial benefits include:

- Significant Cost Savings: Up to 60% lower annual cost versus in-house employees, eliminating major overheads like benefits, office space, and equipment.

- Enhanced Efficiency: Payroll VAs reduce errors, speed up pay cycles, and automate tax/reporting work.

- Scalability & Flexibility: Easily scale up or down; no long-term contracts or severance costs.

- Expertise-on-Demand: Access to professionals with payroll, tax, and compliance experience—fewer mistakes, more confidence in regulatory filings.

- Compliance & Risk Reduction: Reduced legal and tax risks from misclassification, late filings, or payroll errors.

- Business Continuity: Teams can focus on core operations and growth, while VAs ensure payroll runs smoothly even in distributed or hybrid workplaces.

- Data Security: Modern platforms ensure confidential employee and payment data remains secure.

- Turnkey Global Payroll:S. payroll VAs can handle multi-state, remote, or even cross-border payroll requirements.

Conclusion

Payrolling virtual assistant services in the USA is a high-impact strategy for businesses aiming to reduce operational overhead, maximize efficiency, and stay agile in a fast-changing environment. With robust compliance, cost, and workflow advantages, organizations large and small can securely delegate payroll management for exponential ROI and peace of mind in 2025 and beyond.

Reference Tables

- Cost comparison: In-house vs. Virtual Assistant payroll management (Mid-level, annual, USA)

- Payroll Virtual Assistant Service Packages & Rates (USA, Nov 2025)

- Payroll Compliance for Virtual Assistant Services in the USA: Key Legal & Reporting Differences

For a tailored payroll VA strategy or more in-depth legal/compliance guidance, consult with a payroll specialist or virtual staffing agency.

Frequently Asked Questions (FAQs)

A payroll virtual assistant is a trained remote professional who manages your business's payroll operations from a distance, typically as an independent contractor rather than an in-house employee. Their core responsibilities include calculating accurate paychecks, managing tax withholdings, processing direct deposits, filing compliance forms (W-2s and 1099s), maintaining employee records, tracking time and attendance, generating payroll reports, and ensuring adherence to federal and state labor laws. They serve as an extension of your finance or HR team, reducing administrative burden while ensuring accuracy and regulatory compliance.

Businesses typically save 30–60% annually by hiring payroll VAs versus employing in-house payroll staff. For a mid-level payroll role, in-house employment costs approximately $95,500 per year (including salary, benefits, taxes, equipment, and management overhead), while a virtual assistant costs around $71,400 annually—delivering $24,100 in savings. Hourly rates for payroll VAs range from $8–$25 per hour depending on experience and location, with monthly retainer packages starting at approximately $999 for general admin support and reaching $2,400+ for executive-level payroll services. Unlike employees, VAs don't receive benefits, vacation pay, or employer-sponsored health insurance, which accounts for most savings.

In most cases, virtual assistants are classified as independent contractors, not employees. This means your business is not responsible for providing health insurance, vacation pay, workers' compensation, or other traditional employee benefits. However, misclassification carries significant legal and financial risks. If the IRS determines that a VA should have been classified as an employee, your business could face penalties including unpaid payroll taxes, Social Security and Medicare withholding, unemployment insurance, FMLA compliance violations, and back pay. The classification depends on factors such as control over work hours, resources used, level of supervision, and payment structure. To determine correct classification, consult an employment attorney and ensure your VA agreement clearly defines independence, payment terms, and scope of work.

A 1099-NEC (Nonemployee Compensation) form is an IRS tax document that must be issued to independent contractors who receive $600 or more in annual payments from your business. The 1099-NEC reports the total amount paid to the contractor and must be filed by January 31st of the following year with both the IRS and the contractor. Unlike W-2 employees, you are not responsible for withholding taxes from VA payments—the contractor handles their own tax obligations. Proper 1099 reporting is critical for compliance; failure to file timely 1099s or misclassifying employees as contractors can result in substantial penalties and legal consequences.

Leading payroll VAs are proficient across multiple industry-standard platforms including QuickBooks, Gusto, ADP, Paychex, Xero, BambooHR, and specialized agency systems. When hiring a payroll VA, inquire about their experience with your preferred payroll software. Modern platforms integrate with cloud-based solutions for real-time time tracking, automated tax calculations, direct deposit processing, secure recordkeeping, and detailed compliance reporting. Many VA agencies allow you to filter candidates by tool proficiency, ensuring they can work seamlessly with your existing systems without a lengthy learning curve.

Data security is non-negotiable because payroll VAs access highly sensitive information including employee names, addresses, Social Security numbers, salaries, and bank account details. Implement these protective measures: (1) Require a written Non-Disclosure Agreement (NDA) to bind confidentiality obligations; (2) Use encrypted, cloud-based payroll software rather than spreadsheets or unprotected emails; (3) Ask about security certifications such as ISO 27001, SOC 2, or GDPR compliance; (4) Implement multi-factor authentication for system access; (5) Request a Data Processing Agreement (DPA) if your VA or their agency processes data; and (6) Use password managers like LastPass for secure credential sharing. Ensure your VA provider uses role-based access controls, encrypted backups, and maintains audit trails to monitor system access. For businesses handling cross-border data, verify GDPR compliance and adherence to Standard Contractual Clauses (SCCs).

Payroll compliance involves multiple layers: (1) Federal compliance includes accurate calculation of federal income tax, Social Security (6.2%), and Medicare (1.45%) withholding; (2) State compliance varies by location—some states have additional income taxes, disability insurance, or paid leave requirements; (3) Worker classification must be correct (employee vs. contractor) to avoid IRS penalties; (4) Form filing requires timely submission of W-2s (for employees), 1099-NECs (for contractors earning $600+), quarterly payroll tax filings (941), and annual reconciliation forms (940); and (5) Record retention mandates maintaining payroll records for at least 3–7 years depending on record type and state law. Many payroll VAs are trained to stay updated on regulatory changes through industry newsletters, webinars, and tax professional consultation.

A structured onboarding timeline typically spans 4–8 weeks and follows these phases: (1) Pre-boarding (1–3 days before start): Complete paperwork, sign NDA, and review company policies; (2) Orientation (1 week): System access setup, payroll software training, company culture overview, and team introductions; (3) Job training (2–4 weeks): Detailed walkthrough of payroll processes, standard operating procedures (SOPs), software proficiency, compliance procedures, and handling edge cases; (4) Ramp-up phase (2–4 weeks): Gradually increasing responsibilities while receiving feedback and mentoring; and (5) Full independence (Week 5–8): VA operates independently with periodic check-ins. Best practices include providing video tutorials, written SOP guides, a peer mentor or direct manager contact, and clear KPIs. A well-planned 30–60–90 day roadmap helps assess progress and identify areas needing additional support.

Essential technical skills: (1) Proficiency in payroll software (QuickBooks, Gusto, ADP, Paychex, Xero); (2) Strong Excel/spreadsheet capabilities; (3) Understanding of tax calculations, deductions, and withholding; (4) Familiarity with HRIS (Human Resource Information Systems) platforms; and (5) Knowledge of compliance filing requirements. Soft skills and attributes: (1) Meticulous attention to detail (payroll errors are costly); (2) Strong organizational skills for managing multiple employee records; (3) Excellent communication for clarifying complex payroll scenarios; (4) Reliability and time management (payroll deadlines are non-negotiable); (5) Problem-solving ability for handling edge cases or compliance questions; and (6) Adaptability to different company sizes and industries. Certifications valued by employers include: Certified Payroll Professional (CPP), Google Ads Certification, and Microsoft Office Specialist. Check references or portfolio examples to verify a proven track record before hiring.

Common payroll mistakes include: (1) Incorrect employee information (wrong names, Social Security numbers, or bank details)—prevented through payroll software validation checks and regular data audits; (2) Misclassifying employees as contractors or vice versa—requires careful review of IRS guidelines and worker status verification; (3) Wrong tax withholdings (underpaying or overpaying federal/state taxes)—avoided using software that automatically applies current tax rates; (4) Inaccurate time tracking (miscalculating hours, overtime, or leave)—resolved by syncing time-tracking tools with payroll systems; (5) Missing or incorrect deductions (health insurance, retirement, garnishments)—prevented through centralized record-keeping and software reminders; (6) Late payroll processing (missing pay cycles or deadlines)—avoided by setting automated reminders and maintaining a consistent payroll calendar; and (7) Non-compliance with state regulations (varying leave laws, minimum wage changes)—addressed by staying current with regulatory updates. Modern payroll software automates many preventive measures through validation checks, audit trails, and compliance updates.

Yes, experienced payroll VAs can manage complex, multi-state payroll, but it requires specialized expertise. Multi-state payroll involves navigating different state income tax rates, withholding requirements, paid leave mandates, wage and hour laws, and unemployment insurance regulations. Some states have specific rules around minimum wage, overtime calculation, required deductions, and paid sick leave that must be correctly applied. For international/multi-country payroll, VAs must understand currency conversions, tax treaties, localized compliance requirements, and foreign exchange considerations. Ensure your VA has: (1) Demonstrated experience across the states or countries where you operate; (2) Proficiency with payroll software that supports multi-jurisdictional calculations; (3) Knowledge of specific state/country labor laws; and (4) Access to updated compliance resources. For complex multi-country scenarios, consult with tax professionals or use specialized multi-country payroll providers.

A comprehensive payroll VA service agreement should include: (1) Scope of work: Detailed description of all payroll tasks, frequency (weekly, bi-weekly, monthly), and deliverables; (2) Compensation terms: Hourly rate, payment schedule, invoice procedures, and any retainer or project-based fees; (3) Confidentiality and NDA: Clear statement that VA will maintain confidentiality of all employee and business data; (4) Data security obligations: Requirements for encrypted storage, secure access, password protocols, and breach notification procedures; (5) Compliance responsibilities: Who is responsible for filing forms, managing deadlines, and staying updated on regulatory changes; (6) Term and termination: Length of engagement, notice period for termination, and post-termination data handling; (7) Intellectual property: Clarification that business processes, templates, and proprietary systems remain your property; (8) Communication protocols: Preferred contact methods, response time expectations, and escalation procedures; (9) Performance metrics and KPIs: Accuracy targets, deadline compliance, and quality standards; and (10) Liability and insurance: Clarification of liability limits and any required insurance coverage (cyber liability insurance for payroll VAs is recommended).

Effective performance monitoring includes: (1) Key Performance Indicators (KPIs): Set measurable targets such as 99%+ payroll accuracy, 100% deadline compliance, zero late payments, and zero compliance filing errors; (2) Task completion tracking: Use project management tools (Trello, Asana, ClickUp) to log all payroll tasks and monitor completion rates; (3) Accuracy audits: Randomly verify payroll calculations, tax withholdings, and filings against your records to catch errors early; (4) Response times: Measure how quickly the VA responds to questions and addresses issues; (5) Compliance checklist: Track whether all required filings (W-2s, 941s, state returns) are submitted on time; (6) Regular check-ins: Schedule weekly or bi-weekly meetings to discuss workload, challenges, and performance; (7) Employee feedback: Ask employees or HR staff if paycheck accuracy, timing, and communication meet expectations; and (8) Trend analysis: Review payroll data over time to identify patterns, such as recurring types of errors or processing delays. Document all feedback and performance data for future reference and performance reviews.

General Virtual Assistants handle broad administrative tasks including email management, scheduling, calendar coordination, data entry, customer service, social media, research, and light bookkeeping. They offer flexibility for varied work but may lack deep payroll expertise. Specialist Payroll VAs are trained specifically in payroll processing, tax compliance, HRIS systems, and regulatory requirements. They possess in-depth knowledge of payroll software (QuickBooks, Gusto, ADP), tax calculation, multi-state compliance, deduction management, and form filing. When to hire each: Choose a general VA if your payroll needs are straightforward, part-time, or bundled with other administrative support. Choose a specialist payroll VA if you require accuracy-critical work, complex multi-state/multi-employee payroll, compliance expertise, or full-service payroll management. Specialist payroll VAs typically command higher hourly rates ($18–$25/hr vs. $10–$15/hr for generalists) but deliver greater accuracy, compliance confidence, and reduced errors.

Top 20 FAQs: Payrolling Virtual Assistant Services in the USA

1. What exactly is a payroll virtual assistant, and what tasks do they handle?

A payroll virtual assistant is a trained remote professional who manages your business's payroll operations from a distance, typically as an independent contractor rather than an in-house employee. Their core responsibilities include calculating accurate paychecks, managing tax withholdings, processing direct deposits, filing compliance forms (W-2s and 1099s), maintaining employee records, tracking time and attendance, generating payroll reports, and ensuring adherence to federal and state labor laws. They serve as an extension of your finance or HR team, reducing administrative burden while ensuring accuracy and regulatory compliance.

2. How much does hiring a payroll virtual assistant cost compared to an in-house payroll employee?

Businesses typically save 30–60% annually by hiring payroll VAs versus employing in-house payroll staff. For a mid-level payroll role, in-house employment costs approximately $95,500 per year (including salary, benefits, taxes, equipment, and management overhead), while a virtual assistant costs around $71,400 annually—delivering $24,100 in savings. Hourly rates for payroll VAs range from $8–$25 per hour depending on experience and location, with monthly retainer packages starting at approximately $999 for general admin support and reaching $2,400+ for executive-level payroll services. Unlike employees, VAs don't receive benefits, vacation pay, or employer-sponsored health insurance, which accounts for most savings.

3. Are virtual assistants classified as employees or independent contractors?

In most cases, virtual assistants are classified as independent contractors, not employees. This means your business is not responsible for providing health insurance, vacation pay, workers' compensation, or other traditional employee benefits. However, misclassification carries significant legal and financial risks. If the IRS determines that a VA should have been classified as an employee, your business could face penalties including unpaid payroll taxes, Social Security and Medicare withholding, unemployment insurance, FMLA compliance violations, and back pay. The classification depends on factors such as control over work hours, resources used, level of supervision, and payment structure. To determine correct classification, consult an employment attorney and ensure your VA agreement clearly defines independence, payment terms, and scope of work.

4. What is a 1099 form, and why is it important for payroll VAs?

A 1099-NEC (Nonemployee Compensation) form is an IRS tax document that must be issued to independent contractors who receive $600 or more in annual payments from your business. The 1099-NEC reports the total amount paid to the contractor and must be filed by January 31st of the following year with both the IRS and the contractor. Unlike W-2 employees, you are not responsible for withholding taxes from VA payments—the contractor handles their own tax obligations. Proper 1099 reporting is critical for compliance; failure to file timely 1099s or misclassifying employees as contractors can result in substantial penalties and legal consequences.

5. What payroll software and tools do virtual assistants typically use?

Leading payroll VAs are proficient across multiple industry-standard platforms including QuickBooks, Gusto, ADP, Paychex, Xero, BambooHR, and specialized agency systems. When hiring a payroll VA, inquire about their experience with your preferred payroll software. Modern platforms integrate with cloud-based solutions for real-time time tracking, automated tax calculations, direct deposit processing, secure recordkeeping, and detailed compliance reporting. Many VA agencies allow you to filter candidates by tool proficiency, ensuring they can work seamlessly with your existing systems without a lengthy learning curve.

6. How do I ensure data security and compliance when hiring a payroll VA?

Data security is non-negotiable because payroll VAs access highly sensitive information including employee names, addresses, Social Security numbers, salaries, and bank account details. Implement these protective measures: (1) Require a written Non-Disclosure Agreement (NDA) to bind confidentiality obligations; (2) Use encrypted, cloud-based payroll software rather than spreadsheets or unprotected emails; (3) Ask about security certifications such as ISO 27001, SOC 2, or GDPR compliance; (4) Implement multi-factor authentication for system access; (5) Request a Data Processing Agreement (DPA) if your VA or their agency processes data; and (6) Use password managers like LastPass for secure credential sharing. Ensure your VA provider uses role-based access controls, encrypted backups, and maintains audit trails to monitor system access. For businesses handling cross-border data, verify GDPR compliance and adherence to Standard Contractual Clauses (SCCs).

7. What are the key compliance requirements for payroll VAs in the USA?

Payroll compliance involves multiple layers: (1) Federal compliance includes accurate calculation of federal income tax, Social Security (6.2%), and Medicare (1.45%) withholding; (2) State compliance varies by location—some states have additional income taxes, disability insurance, or paid leave requirements; (3) Worker classification must be correct (employee vs. contractor) to avoid IRS penalties; (4) Form filing requires timely submission of W-2s (for employees), 1099-NECs (for contractors earning $600+), quarterly payroll tax filings (941), and annual reconciliation forms (940); and (5) Record retention mandates maintaining payroll records for at least 3–7 years depending on record type and state law. Many payroll VAs are trained to stay updated on regulatory changes through industry newsletters, webinars, and tax professional consultation.

8. How long does the onboarding process take for a payroll VA?

A structured onboarding timeline typically spans 4–8 weeks and follows these phases: (1) Pre-boarding (1–3 days before start): Complete paperwork, sign NDA, and review company policies; (2) Orientation (1 week): System access setup, payroll software training, company culture overview, and team introductions; (3) Job training (2–4 weeks): Detailed walkthrough of payroll processes, standard operating procedures (SOPs), software proficiency, compliance procedures, and handling edge cases; (4) Ramp-up phase (2–4 weeks): Gradually increasing responsibilities while receiving feedback and mentoring; and (5) Full independence (Week 5–8): VA operates independently with periodic check-ins. Best practices include providing video tutorials, written SOP guides, a peer mentor or direct manager contact, and clear KPIs. A well-planned 30–60–90 day roadmap helps assess progress and identify areas needing additional support.

9. What specific skills should I look for when hiring a payroll VA?

Essential technical skills: (1) Proficiency in payroll software (QuickBooks, Gusto, ADP, Paychex, Xero); (2) Strong Excel/spreadsheet capabilities; (3) Understanding of tax calculations, deductions, and withholding; (4) Familiarity with HRIS (Human Resource Information Systems) platforms; and (5) Knowledge of compliance filing requirements. Soft skills and attributes: (1) Meticulous attention to detail (payroll errors are costly); (2) Strong organizational skills for managing multiple employee records; (3) Excellent communication for clarifying complex payroll scenarios; (4) Reliability and time management (payroll deadlines are non-negotiable); (5) Problem-solving ability for handling edge cases or compliance questions; and (6) Adaptability to different company sizes and industries. Certifications valued by employers include: Certified Payroll Professional (CPP), Google Ads Certification, and Microsoft Office Specialist. Check references or portfolio examples to verify a proven track record before hiring.

10. What are the most common payroll errors, and how can a VA prevent them?

Common payroll mistakes include: (1) Incorrect employee information (wrong names, Social Security numbers, or bank details)—prevented through payroll software validation checks and regular data audits; (2) Misclassifying employees as contractors or vice versa—requires careful review of IRS guidelines and worker status verification; (3) Wrong tax withholdings (underpaying or overpaying federal/state taxes)—avoided using software that automatically applies current tax rates; (4) Inaccurate time tracking (miscalculating hours, overtime, or leave)—resolved by syncing time-tracking tools with payroll systems; (5) Missing or incorrect deductions (health insurance, retirement, garnishments)—prevented through centralized record-keeping and software reminders; (6) Late payroll processing (missing pay cycles or deadlines)—avoided by setting automated reminders and maintaining a consistent payroll calendar; and (7) Non-compliance with state regulations (varying leave laws, minimum wage changes)—addressed by staying current with regulatory updates. Modern payroll software automates many preventive measures through validation checks, audit trails, and compliance updates.

11. Can a payroll VA handle multi-state or multi-country payroll?

Yes, experienced payroll VAs can manage complex, multi-state payroll, but it requires specialized expertise. Multi-state payroll involves navigating different state income tax rates, withholding requirements, paid leave mandates, wage and hour laws, and unemployment insurance regulations. Some states have specific rules around minimum wage, overtime calculation, required deductions, and paid sick leave that must be correctly applied. For international/multi-country payroll, VAs must understand currency conversions, tax treaties, localized compliance requirements, and foreign exchange considerations. Ensure your VA has: (1) Demonstrated experience across the states or countries where you operate; (2) Proficiency with payroll software that supports multi-jurisdictional calculations; (3) Knowledge of specific state/country labor laws; and (4) Access to updated compliance resources. For complex multi-country scenarios, consult with tax professionals or use specialized multi-country payroll providers.

12. What should be included in a payroll VA service agreement or contract?

A comprehensive payroll VA service agreement should include: (1) Scope of work: Detailed description of all payroll tasks, frequency (weekly, bi-weekly, monthly), and deliverables; (2) Compensation terms: Hourly rate, payment schedule, invoice procedures, and any retainer or project-based fees; (3) Confidentiality and NDA: Clear statement that VA will maintain confidentiality of all employee and business data; (4) Data security obligations: Requirements for encrypted storage, secure access, password protocols, and breach notification procedures; (5) Compliance responsibilities: Who is responsible for filing forms, managing deadlines, and staying updated on regulatory changes; (6) Term and termination: Length of engagement, notice period for termination, and post-termination data handling; (7) Intellectual property: Clarification that business processes, templates, and proprietary systems remain your property; (8) Communication protocols: Preferred contact methods, response time expectations, and escalation procedures; (9) Performance metrics and KPIs: Accuracy targets, deadline compliance, and quality standards; and (10) Liability and insurance: Clarification of liability limits and any required insurance coverage (cyber liability insurance for payroll VAs is recommended).

13. How can I monitor and measure a payroll VA's performance?

Effective performance monitoring includes: (1) Key Performance Indicators (KPIs): Set measurable targets such as 99%+ payroll accuracy, 100% deadline compliance, zero late payments, and zero compliance filing errors; (2) Task completion tracking: Use project management tools (Trello, Asana, ClickUp) to log all payroll tasks and monitor completion rates; (3) Accuracy audits: Randomly verify payroll calculations, tax withholdings, and filings against your records to catch errors early; (4) Response times: Measure how quickly the VA responds to questions and addresses issues; (5) Compliance checklist: Track whether all required filings (W-2s, 941s, state returns) are submitted on time; (6) Regular check-ins: Schedule weekly or bi-weekly meetings to discuss workload, challenges, and performance; (7) Employee feedback: Ask employees or HR staff if paycheck accuracy, timing, and communication meet expectations; and (8) Trend analysis: Review payroll data over time to identify patterns, such as recurring types of errors or processing delays. Document all feedback and performance data for future reference and performance reviews.

14. What is the difference between a general VA and a specialist payroll VA?

General Virtual Assistants handle broad administrative tasks including email management, scheduling, calendar coordination, data entry, customer service, social media, research, and light bookkeeping. They offer flexibility for varied work but may lack deep payroll expertise. Specialist Payroll VAs are trained specifically in payroll processing, tax compliance, HRIS systems, and regulatory requirements. They possess in-depth knowledge of payroll software (QuickBooks, Gusto, ADP), tax calculation, multi-state compliance, deduction management, and form filing. When to hire each: Choose a general VA if your payroll needs are straightforward, part-time, or bundled with other administrative support. Choose a specialist payroll VA if you require accuracy-critical work, complex multi-state/multi-employee payroll, compliance expertise, or full-service payroll management. Specialist payroll VAs typically command higher hourly rates ($18–$25/hr vs. $10–$15/hr for generalists) but deliver greater accuracy, compliance confidence, and reduced errors.

15. Can I hire a payroll VA through an agency, or should I hire independently?

Both models have distinct advantages and trade-offs:

| Hiring Model | Advantages | Disadvantages | Best For |

|---|---|---|---|

| Agency Model | Pre-vetted staff, quality guarantees, replacement policy if VA underperforms, established security/compliance, training & support included, no hiring/management overhead | Higher rates (20–30% markup), less direct control, potential communication delays | Businesses prioritizing reliability, compliance, and reduced hiring burden |

| Independent Contractor | Lower rates, direct communication, more control over work style, flexibility to customize tasks | Responsibility for vetting, training, and management; no quality guarantee; must handle compliance; limited backup if VA becomes unavailable | Budget-conscious businesses with clear needs and ability to manage remote contractors |

Hybrid approach: Some businesses hire through an agency initially (lower risk, faster onboarding), then transition to independent contractors once processes are established and trusted VAs identified. Platforms like Upwork, Fiverr, and freelance sites enable direct hiring but require more due diligence, while specialized VA agencies (Remote CoWorker, Prialto, Virtual Assist USA) offer curated talent with built-in quality controls.

16. What liability and insurance considerations apply to payroll VAs?

Insurance and liability considerations: (1) VA's Insurance: Payroll VAs should carry cyber liability insurance (data breach coverage, recovery costs, legal claims from cyber-attacks) and professional liability insurance (errors and omissions coverage). Ask potential VAs or agencies about their insurance coverage before engagement; (2) Your Business Liability: Even though the VA is a contractor, you remain liable for payroll compliance, tax filing accuracy, and employee data protection. If the VA makes a payroll error or data breach occurs, your business faces legal and financial consequences; (3) Non-Disclosure Agreements (NDAs): A signed NDA protects confidential information but doesn't shield you from liability for external breaches; (4) Vendor Management: Treat your payroll VA as a critical vendor—request proof of insurance, security certifications, and a signed Service Level Agreement (SLA) outlining their obligations; (5) Indemnification clauses: Consider including language where the VA agrees to indemnify your business for their errors or data breaches (though enforceability varies); and (6) Background checks: Reputable VA agencies conduct background checks on employees before assignment. Verify this before hiring.

17. How do I transition from in-house payroll to a virtual assistant model?

A successful transition typically unfolds over 4–6 weeks and involves: (1) Documentation (Week 1): Create comprehensive SOPs (Standard Operating Procedures) documenting all payroll processes, timelines, employee lists, tax filing requirements, software access protocols, and emergency procedures; (2) VA selection and onboarding (Week 2–3): Hire or contract with your payroll VA, grant system access, provide orientation to your business, and establish communication channels; (3) Parallel processing (Week 3–4): Run payroll simultaneously with both your in-house team and the new VA to ensure accuracy and catch any discrepancies. Compare results before finalizing transition; (4) Knowledge transfer (Week 3–5): Conduct detailed training sessions, provide written guides, share payroll calendars, discuss unique company requirements (bonuses, commission structures, deductions), and clarify escalation procedures; (5) Soft launch (Week 5): Have the VA process a full payroll cycle with your team's review and approval before going live; and (6) Full handoff (Week 6+): VA assumes full responsibility with ongoing check-ins for the first 2–3 months. Maintain thorough documentation and keep your in-house team involved initially for questions and feedback. This gradual approach minimizes errors and ensures business continuity.

18. What communication and collaboration tools work best for managing a payroll VA remotely?

Recommended communication and collaboration tools include: (1) Project management: Trello, Asana, or ClickUp for tracking payroll tasks, deadlines, and deliverables; (2) Messaging and quick communication: Slack for real-time updates, questions, and quick clarifications without cluttering email; (3) Email: Formal documentation, contracts, sensitive data sharing, and audit trails; (4) Video conferencing: Zoom, Google Meet, or Teams for training, complex discussions, onboarding, and relationship building; (5) File storage and sharing: Google Drive, Dropbox, or Microsoft OneDrive for centralized document management with version control and access permissions; (6) Payroll software portals: Many platforms (QuickBooks, Gusto, ADP) have built-in communication features for alerts, notifications, and compliance updates; and (7) Time tracking and monitoring: Tools like ClickUp or Toggl allow VAs to log work hours, and many agencies provide free monitoring portals for real-time visibility into VA activities. Best practice: Establish clear protocols—e.g., urgent matters via Slack, daily updates via project management tool, formal communications via email. Set response time expectations (typically 24 hours) and define which channel handles which types of communication.

19. What common mistakes should I avoid when hiring a payroll VA?

Major pitfalls to prevent: (1) Vague job descriptions: Failing to clearly define payroll tasks, software requirements, frequency, and quality standards leads to miscommunication and unmet expectations. Be specific about what success looks like; (2) Overlooking security requirements: Don't skip NDAs, security protocols, or background checks—inadequate safeguards put sensitive employee data at risk; (3) No performance metrics: Without defined KPIs (accuracy rate, deadline compliance, error count), you can't objectively measure performance or justify costs; (4) Unrealistic expectations: Expecting perfection on day one ignores the learning curve. Allow 1–2 weeks for complex tasks and provide constructive feedback instead of frustration; (5) Insufficient onboarding: Skipping proper training, SOPs, and mentorship results in errors, longer ramp-up time, and lower quality; (6) Inadequate communication channels: Poor communication leads to missed deadlines, misunderstood requirements, and preventable errors. Establish multiple communication channels and check-in schedules; (7) No written agreement: Vague verbal arrangements lead to disputes over scope, payment, and responsibilities. Always use a written service agreement; (8) Ignoring cultural fit: Technical skills alone don't guarantee success—assess communication style, reliability, initiative, and values alignment during interviews; and (9) No contingency plan: What happens if your VA becomes unavailable? Have a backup plan, documented processes, and access to shared systems maintained by more than one person.

20. How do I handle payroll errors that a VA makes, and what's the correction process?

When a payroll error occurs, follow these steps: (1) Quickly identify the error: Review payroll reports, employee paystubs, and tax filings against your records. Common issues include incorrect withholding, missing deductions, wrong hours, or calculation errors; (2) Notify all stakeholders: Inform the VA, affected employees, your accounting team, and management immediately—transparency prevents downstream issues; (3) Calculate the correct amounts: Determine what employees should have received versus what was paid, including any tax implications; (4) Adjust the payroll system: Input corrections through your payroll software (most platforms allow amended payroll entries) and generate corrected paystubs; (5) Process corrections: Issue corrected paystubs and, if necessary, supplemental checks to affected employees to bring them to correct net pay; (6) Update tax filings: If the error affected tax withholding, file amended tax forms (Form 941-X for federal quarterly adjustments, state equivalents as needed) and inform the IRS/state if required; (7) Document everything: Keep detailed records of the error, correction steps, communications, and new payroll records for future reference and potential audits; and (8) Implement preventive measures: Work with your VA to identify root cause (system error, training gap, procedural gap) and update processes, training, or software settings to prevent recurrence. Regular audits catch errors early before they affect multiple pay cycles.

Insurance and liability considerations: (1) VA's Insurance: Payroll VAs should carry cyber liability insurance (data breach coverage, recovery costs, legal claims from cyber-attacks) and professional liability insurance (errors and omissions coverage). Ask potential VAs or agencies about their insurance coverage before engagement; (2) Your Business Liability: Even though the VA is a contractor, you remain liable for payroll compliance, tax filing accuracy, and employee data protection. If the VA makes a payroll error or data breach occurs, your business faces legal and financial consequences; (3) Non-Disclosure Agreements (NDAs): A signed NDA protects confidential information but doesn't shield you from liability for external breaches; (4) Vendor Management: Treat your payroll VA as a critical vendor—request proof of insurance, security certifications, and a signed Service Level Agreement (SLA) outlining their obligations; (5) Indemnification clauses: Consider including language where the VA agrees to indemnify your business for their errors or data breaches (though enforceability varies); and (6) Background checks: Reputable VA agencies conduct background checks on employees before assignment. Verify this before hiring.

A successful transition typically unfolds over 4–6 weeks and involves: (1) Documentation (Week 1): Create comprehensive SOPs (Standard Operating Procedures) documenting all payroll processes, timelines, employee lists, tax filing requirements, software access protocols, and emergency procedures; (2) VA selection and onboarding (Week 2–3): Hire or contract with your payroll VA, grant system access, provide orientation to your business, and establish communication channels; (3) Parallel processing (Week 3–4): Run payroll simultaneously with both your in-house team and the new VA to ensure accuracy and catch any discrepancies. Compare results before finalizing transition; (4) Knowledge transfer (Week 3–5): Conduct detailed training sessions, provide written guides, share payroll calendars, discuss unique company requirements (bonuses, commission structures, deductions), and clarify escalation procedures; (5) Soft launch (Week 5): Have the VA process a full payroll cycle with your team's review and approval before going live; and (6) Full handoff (Week 6+): VA assumes full responsibility with ongoing check-ins for the first 2–3 months. Maintain thorough documentation and keep your in-house team involved initially for questions and feedback. This gradual approach minimizes errors and ensures business continuity.

Recommended communication and collaboration tools include: (1) Project management: Trello, Asana, or ClickUp for tracking payroll tasks, deadlines, and deliverables; (2) Messaging and quick communication: Slack for real-time updates, questions, and quick clarifications without cluttering email; (3) Email: Formal documentation, contracts, sensitive data sharing, and audit trails; (4) Video conferencing: Zoom, Google Meet, or Teams for training, complex discussions, onboarding, and relationship building; (5) File storage and sharing: Google Drive, Dropbox, or Microsoft OneDrive for centralized document management with version control and access permissions; (6) Payroll software portals: Many platforms (QuickBooks, Gusto, ADP) have built-in communication features for alerts, notifications, and compliance updates; and (7) Time tracking and monitoring: Tools like ClickUp or Toggl allow VAs to log work hours, and many agencies provide free monitoring portals for real-time visibility into VA activities. Best practice: Establish clear protocols—e.g., urgent matters via Slack, daily updates via project management tool, formal communications via email. Set response time expectations (typically 24 hours) and define which channel handles which types of communication.

Major pitfalls to prevent: (1) Vague job descriptions: Failing to clearly define payroll tasks, software requirements, frequency, and quality standards leads to miscommunication and unmet expectations. Be specific about what success looks like; (2) Overlooking security requirements: Don't skip NDAs, security protocols, or background checks—inadequate safeguards put sensitive employee data at risk; (3) No performance metrics: Without defined KPIs (accuracy rate, deadline compliance, error count), you can't objectively measure performance or justify costs; (4) Unrealistic expectations: Expecting perfection on day one ignores the learning curve. Allow 1–2 weeks for complex tasks and provide constructive feedback instead of frustration; (5) Insufficient onboarding: Skipping proper training, SOPs, and mentorship results in errors, longer ramp-up time, and lower quality; (6) Inadequate communication channels: Poor communication leads to missed deadlines, misunderstood requirements, and preventable errors. Establish multiple communication channels and check-in schedules; (7) No written agreement: Vague verbal arrangements lead to disputes over scope, payment, and responsibilities. Always use a written service agreement; (8) Ignoring cultural fit: Technical skills alone don't guarantee success—assess communication style, reliability, initiative, and values alignment during interviews; and (9) No contingency plan: What happens if your VA becomes unavailable? Have a backup plan, documented processes, and access to shared systems maintained by more than one person.

When a payroll error occurs, follow these steps: (1) Quickly identify the error: Review payroll reports, employee paystubs, and tax filings against your records. Common issues include incorrect withholding, missing deductions, wrong hours, or calculation errors; (2) Notify all stakeholders: Inform the VA, affected employees, your accounting team, and management immediately—transparency prevents downstream issues; (3) Calculate the correct amounts: Determine what employees should have received versus what was paid, including any tax implications; (4) Adjust the payroll system: Input corrections through your payroll software (most platforms allow amended payroll entries) and generate corrected paystubs; (5) Process corrections: Issue corrected paystubs and, if necessary, supplemental checks to affected employees to bring them to correct net pay; (6) Update tax filings: If the error affected tax withholding, file amended tax forms (Form 941-X for federal quarterly adjustments, state equivalents as needed) and inform the IRS/state if required; (7) Document everything: Keep detailed records of the error, correction steps, communications, and new payroll records for future reference and potential audits; and (8) Implement preventive measures: Work with your VA to identify root cause (system error, training gap, procedural gap) and update processes, training, or software settings to prevent recurrence. Regular audits catch errors early before they affect multiple pay cycles.

-

AI-Driven SEO Tools and Services:Boosting Rankings with AI

AI-Driven SEO Tools and Services:Boosting Rankings with AI -

Best Manufacturing Employment Agencies In USA

Best Manufacturing Employment Agencies In USA -

Best Technical Search Engine Optimization Agencies in USA

Best Technical Search Engine Optimization Agencies in USA -

Best Email Marketing Services in USA 2025

Best Email Marketing Services in USA 2025 -

Best AI-Driven Digital Marketing in USA 2025

Best AI-Driven Digital Marketing in USA 2025 -

Best Social Media Marketing Services in New York 2025

Best Social Media Marketing Services in New York 2025 -

Best Digital Marketing Services in New York 2025

Best Digital Marketing Services in New York 2025 -

Best Digital Marketing Services in Boston 2025

Best Digital Marketing Services in Boston 2025 -

Best SEO Services in Boston 2025

Best SEO Services in Boston 2025 -

Best Social Media Marketing Services in UAE

Best Social Media Marketing Services in UAE -

Best Website Development Services in Dubai

Best Website Development Services in Dubai -

Best Performance Marketing Services in Dubai

Best Performance Marketing Services in Dubai -

Best SEO Services in Dubai

Best SEO Services in Dubai -

Best Social Media Marketing Services in Dubai

Best Social Media Marketing Services in Dubai -

Best Digital Marketing Services in Dubai

Best Digital Marketing Services in Dubai -

Best Performance Marketing Services in Australia

Best Performance Marketing Services in Australia -

Best Content Writing Services in Thailand

Best Content Writing Services in Thailand -

Best Performance Marketing Services in Thailand

Best Performance Marketing Services in Thailand -

Best SEO services in Thailand

Best SEO services in Thailand -

Best Mobile App Development Services in Thailand

Best Mobile App Development Services in Thailand -

Best Website Development Services in Thailand

Best Website Development Services in Thailand -

Best Social Media Marketing Services in Thailand

Best Social Media Marketing Services in Thailand -

Best Digital Marketing Services In Thailand

Best Digital Marketing Services In Thailand -

Best Social Media Strategies in 2025 for Business Growth

Best Social Media Strategies in 2025 for Business Growth -

Best Mobile App Development Services In Australia

Best Mobile App Development Services In Australia -

Best Google Ads Services in Australia

Best Google Ads Services in Australia -

Best SEO (Search Engine Optimization) services in Australia 2025

Best SEO (Search Engine Optimization) services in Australia 2025 -

Best Email Marketing Services in Australia

Best Email Marketing Services in Australia -

Best Graphic Design Services in Australia

Best Graphic Design Services in Australia -

Top Content Writing Services in Australia

Top Content Writing Services in Australia -

Top Social Media Marketing Services in Australia

Top Social Media Marketing Services in Australia -

Best Digital Marketing Services in Australia

Best Digital Marketing Services in Australia -

Best Website Development Services in Australia

Best Website Development Services in Australia

Also Read

Book a Free Consultation

Ready to elevate your customer experience? Don’t settle for ordinary support. Our dedicated consultants are standing by to match your enterprise with the highest-caliber customer service executives in the USA. From virtual assistants to specialized account managers, we have the expertise and talent pool to meet your needs.

Contact our team today to discuss how our tailored customer executive services can transform your support operations. Let us help you hire or outsource the best customer service executives in USA, so you can focus on growing your business with confidence. Together, we will build a world-class customer support team that drives loyalty and success.